About Course

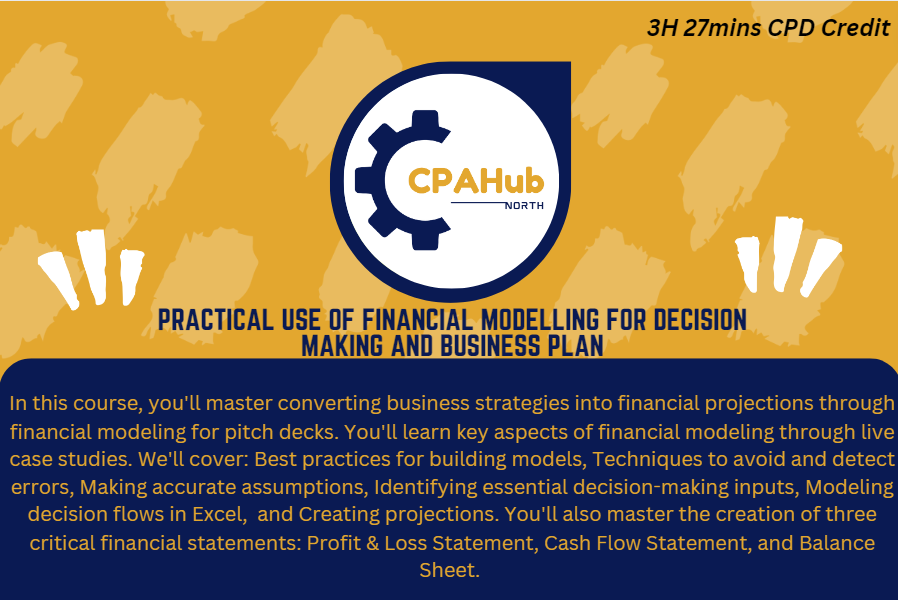

In this course, you'll master converting business strategies into financial projections through financial modeling for pitch decks. You'll learn key aspects of financial modeling through live case studies. We'll cover: Best practices for building models, Techniques to avoid and detect errors, Making accurate assumptions, Identifying essential decision-making inputs, Modeling decision flows in Excel, and Creating projections. You'll also master the creation of three critical financial statements: Profit & Loss Statement, Cash Flow Statement, and Balance Sheet.

As part of the course materials, you'll receive an Excel template used throughout our lessons so you can follow along seamlessly.

Practical use of Financial Modelling for Decision Making and Business Plan

EPISODE LAYOUT

Introduction

- Introduction to the Business Process

- What is Financial Modelling

- Starting Point of a Financial Model

- Key Features of Clear Financial Model and How to get started

- First Steps before Starting to create Financial Model and Linking Business Model

Discussion 1: Case Study- Restaurant - Basic Model for selecting Initial Idea

- Case Study Excel File

- Starting with end in min - Comparative P&L

- Customer Acquisition Model

- Revenue and Cost Models

Discussion 2: Business Plan and 3 Financial Models

- Financial Model for Business plan for New Business Excel File

- Detailed Customer Acquisition Model and Revenue Model

- Cost of Sales Model

- Modelling Labor Cost

- Modelling Other Operating Expenses

- Modelling Income Statement and Cash Flows

- Modelling Balance Sheet

- Fixing the errors in Financial Model and brief of IRR